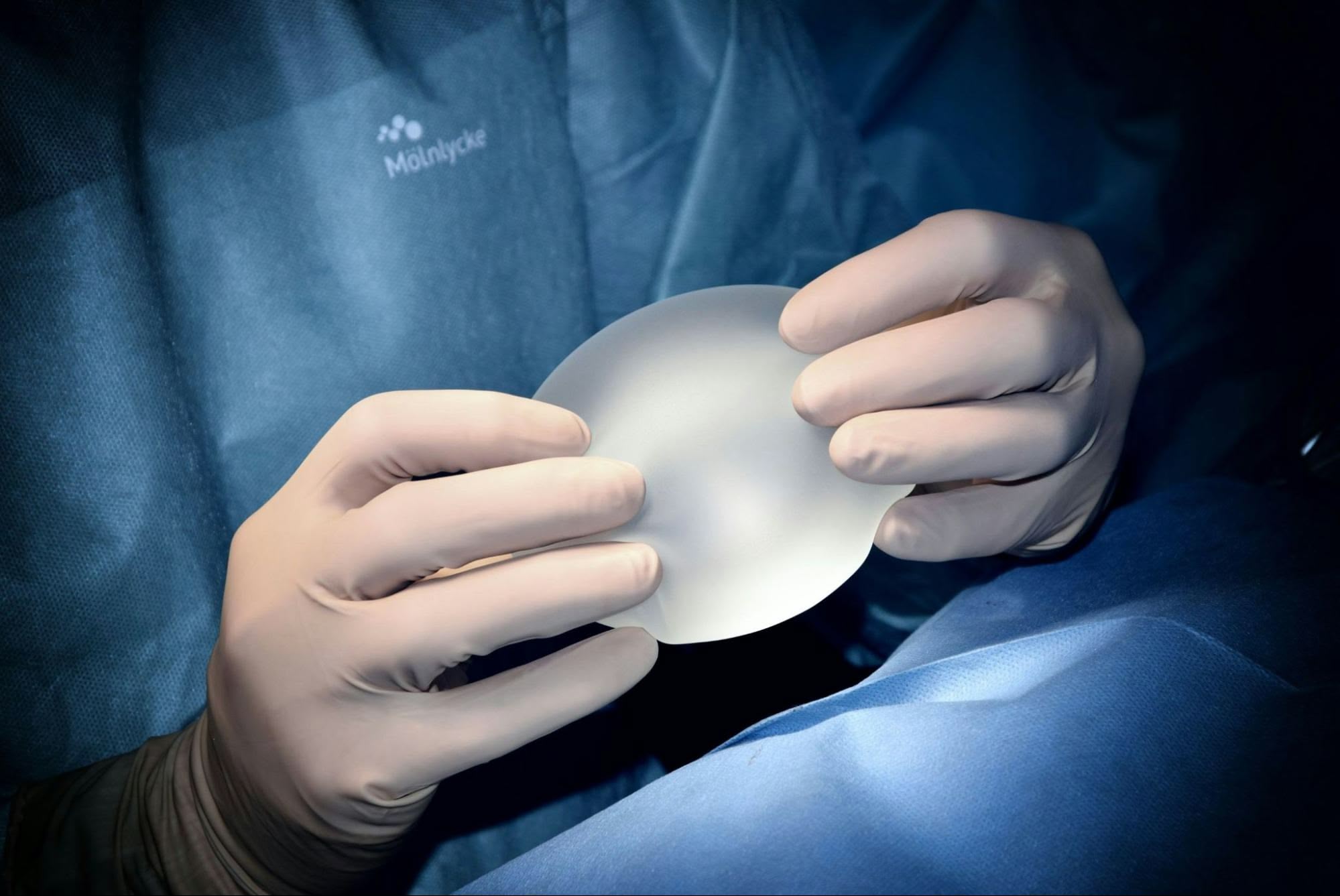

eFinancing Solutions simplifies breast augmentation financing with options tailored for every credit score, offering competitive rates starting at 4.99% APR. We provide flexible terms and multiple loan choices, ensuring accessibility and affordability for all patients. Our efficient Loan Management System ensures smooth handling of agreements with automatic updates and secure data management, making the financing process straightforward and stress-free for both patients and practices.

Ensuring Accessible Financing Options for All Breast Augmentation Patients

At eFinancing Solutions, we understand the importance of making breast augmentation accessible to a diverse range of patients. By offering loan programs tailored to various credit situations, your practice can ensure that more individuals have the opportunity to pursue the procedures they desire.

Our strength lies in our extensive network of lending partners, enabling us to provide a comprehensive range of loan programs that cater to different credit levels. For patients with excellent credit, we offer premium options with highly competitive interest rates. For those with less-than-perfect credit, we still have suitable programs that can help them secure financing.

One of the key features we offer is a soft credit pull, which allows patients to explore their loan options without impacting their credit score. This feature is particularly beneficial for patients who wish to understand their financing possibilities before making a commitment.

For patients with less-than-ideal credit, we offer additional strategies through our lending partners who may consider factors beyond just credit scores—such as income and employment history. This holistic approach increases the chances of securing financing, even for those with challenging credit backgrounds.

We also provide secured loan options and co-signer opportunities—both of which can be instrumental in helping patients qualify for the financing they need.

By offering a diverse range of financing solutions, your practice can make breast augmentation more accessible to a broader patient base, ultimately enhancing patient satisfaction and enabling more individuals to achieve their aesthetic goals.

Benefits Of Offering Multiple Financing Options For Breast Augmentation

Providing a variety of financing options for breast augmentation is a strategic advantage for your practice. This approach not only benefits patients but also strengthens your practice’s reputation and success.

- Boosted Approval Rates – With a wide array of loan programs, your practice can cater to a broader spectrum of patients, increasing the likelihood that they will find a financing option that suits their financial situation. This inclusivity can lead to higher approval rates and more satisfied patients.

- Higher Patient Satisfaction – When patients are presented with choices, they feel empowered to select a plan that aligns with their budget and personal preferences. This level of control contributes to a positive patient experience, leading to better reviews and increased referrals.

- Increased Accessibility – Offering multiple financing options makes breast augmentation more accessible to a wider range of patients. With the right financing plan, procedures that once seemed out of reach can become attainable, helping patients realize their goals.

- Affordability – By providing different loan terms, patients can choose between lower monthly payments or paying less interest over time, depending on their financial priorities. This flexibility allows your practice to accommodate various financial needs and preferences.

- Competitive Edge – For your practice, offering multiple financing options sets you apart from competitors. It demonstrates a commitment to helping patients achieve their desired outcomes, beyond just performing the procedures. This approach not only fosters patient loyalty but also positions your practice as a patient-centered provider in the market.

By offering a diverse range of financing options, your practice can enhance patient satisfaction, build trust, and create a loyal patient base. This multifaceted approach ultimately contributes to a thriving practice, benefiting both patients and healthcare providers through flexible and accessible financing solutions.

Securing Financing For Breast Augmentation With Challenged Credit

For patients with challenged credit, securing financing for breast augmentation can often be a concern. At eFinancing Solutions, we are committed to providing a range of options that allow more patients to access the procedures they desire, regardless of their credit history.

We offer loan programs specifically designed to accommodate various credit levels, including those with lower credit scores. While these programs may come with higher interest rates, they provide an opportunity for patients who might otherwise be unable to secure financing.

Additionally, we offer secured loan options, allowing patients to use an asset as collateral. This approach can significantly improve the likelihood of loan approval, providing a more secure route to financing.

For patients who may need additional support, involving a co-applicant with a stronger credit history can be an effective strategy. This can enhance the overall credit profile of the application, increasing the chances of securing favorable financing terms.

Furthermore, some of our lending partners take a more holistic approach to evaluating loan applications. Beyond just credit scores, they may consider factors such as income, employment history, and overall financial stability. This broader evaluation process can be particularly beneficial for patients who are in stable financial situations despite past credit challenges.

At eFinancing Solutions, our goal is to make breast augmentation financing accessible to a wider range of patients by offering creative and flexible solutions tailored to individual financial circumstances.

Understanding Typical Interest Rates For Breast Augmentation Loans

When offering financing options for breast augmentation, it’s essential to understand the typical interest rates to help guide your patients in making informed decisions. At eFinancing Solutions, we provide competitive interest rates that are designed to make these procedures more affordable for a broad spectrum of patients.

For qualified borrowers with strong credit profiles, interest rates start at 4.99% APR. This rate is generally reserved for applicants with excellent credit scores and those who choose shorter loan terms. However, we recognize that not all patients will fall into this category, which is why we offer a range of rates to suit various financial situations.

Our interest rates typically range from 4.99% to approximately 15-20% for those with less favorable credit histories. The specific rate a patient receives will depend on several factors, including their credit score, the loan amount, and the selected repayment period.

We offer flexible repayment terms extending up to 84 months, providing patients with the option to spread their payments over a longer period. While longer terms can result in lower monthly payments, it is important to consider that they may also lead to higher total interest over the life of the loan. The objective is to find a balance that aligns with the patient’s financial circumstances and goals.

It’s important to note that these rates are variable and may be adjusted based on the individual financial profile of the patient. Our primary goal is to collaborate with your practice to find the most suitable rate and term that fits within your patients’ budgets while helping them achieve their desired outcomes.

Effective Management of Patient Financing Agreements

Managing patient financing agreements can be a streamlined and efficient process with eFinancing Solutions’ Loan Management System. Our platform is designed to simplify the management of patient financing, ensuring that all agreements are organized and accessible.

Our system acts as a comprehensive financial management tool, consolidating all patient financing agreements in one centralized location. This eliminates the need for manual paperwork or the management of multiple spreadsheets, allowing your practice to focus on patient care rather than administrative tasks.

One of the key features of our system is the provision of automatic updates. You will receive timely notifications regarding critical aspects such as application approvals, upcoming payments, and any changes in loan status. This ensures that you are always informed and can manage patient financing with confidence.

Ensuring security when handling sensitive patient financial information is a top priority. Our system employs advanced security measures to protect data, providing peace of mind that patient information is secure and compliant with all relevant regulations.

For reporting and analysis, our system offers the capability to generate detailed financial reports quickly and efficiently. Whether you need to track the number of loans processed, analyze average interest rates, or assess financial performance, the information is readily available with just a few clicks.

Additionally, our Loan Management System integrates seamlessly with many practice management software solutions, reducing the need for repetitive data entry and enhancing workflow efficiency. This integration allows your staff to focus more on delivering quality patient care rather than administrative duties.

Patients also benefit from a user-friendly portal where they can view loan details, make payments, and access their payment history. This self-service functionality enhances the patient experience by providing them with easy access to their financial information.

By utilizing eFinancing Solutions’ Loan Management System, your practice can optimize the management of patient financing agreements, allowing you to devote more time to helping patients achieve their breast augmentation goals.

Transform Your Approach To Breast Augmentation Financing with eFinancing Solutions

Financing breast augmentation procedures can be a seamless and stress-free experience with the right tools and options in place. eFinancing Solutions offers a comprehensive suite of financing solutions designed to meet the needs of both patients and practices.

Our platform provides accessible financing options for patients across all credit levels, ensuring that more individuals can pursue their aesthetic goals. With a variety of financing choices available, including solutions for patients with less-than-perfect credit, eFinancing Solutions is committed to making breast augmentation financially feasible for a broader patient base.

We offer competitive interest rates tailored to different credit situations, allowing your practice to present patients with financing options that align with their financial circumstances. Coupled with our efficient Loan Management System, managing these agreements becomes a straightforward process, freeing up valuable time for your practice to focus on patient care.

eFinancing Solutions is dedicated to supporting your practice in delivering exceptional care while simplifying the financial aspects of breast augmentation. By leveraging our range of financing solutions, you can enhance patient satisfaction and improve the overall efficiency of your practice’s operations.

If your practice is ready to elevate its approach to breast augmentation financing, eFinancing Solutions is here to assist.